India’s Draft Climate Finance Taxonomy – 2025: A Game Changer for Green Investments in India

Introduction

In a strategic move to align financial flows with India’s sustainability goals and promote environmental impact investing, the Department of Economic Affairs under the Ministry of Finance released the Draft Framework of India’s Climate Finance Taxonomy in 2025. This climate taxonomy aims to provide a standardized classification for economic activities based on their environmental impact, helping investors, financial institutions, and policymakers channel climate capital into climate-resilient and low-carbon projects, including carbon neutral investments. The framework is set to revolutionize climate finance in India and is crucial for aspirants preparing for UPSC GS Paper III (Environment, Economy), Essay Paper, and various State PCS and RBI Grade B exams. The Draft Framework is expected to undergo public consultation to ensure it meets the needs of all stakeholders.

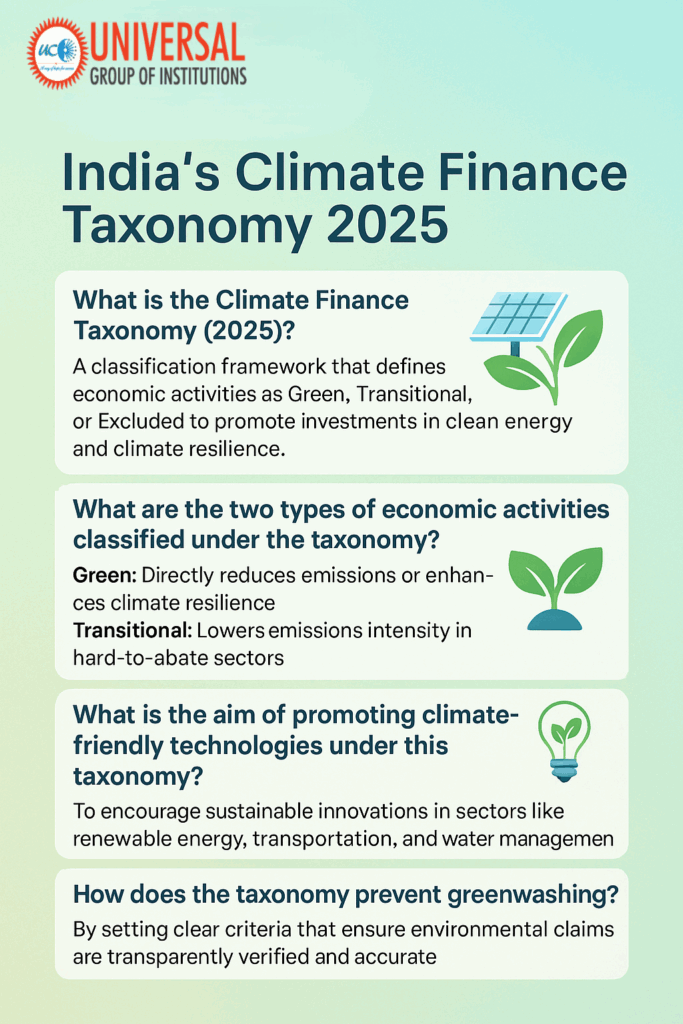

What is Climate Finance Taxonomy?

India’s Climate Finance Taxonomy defines clear criteria and categories to classify economic activities as either:

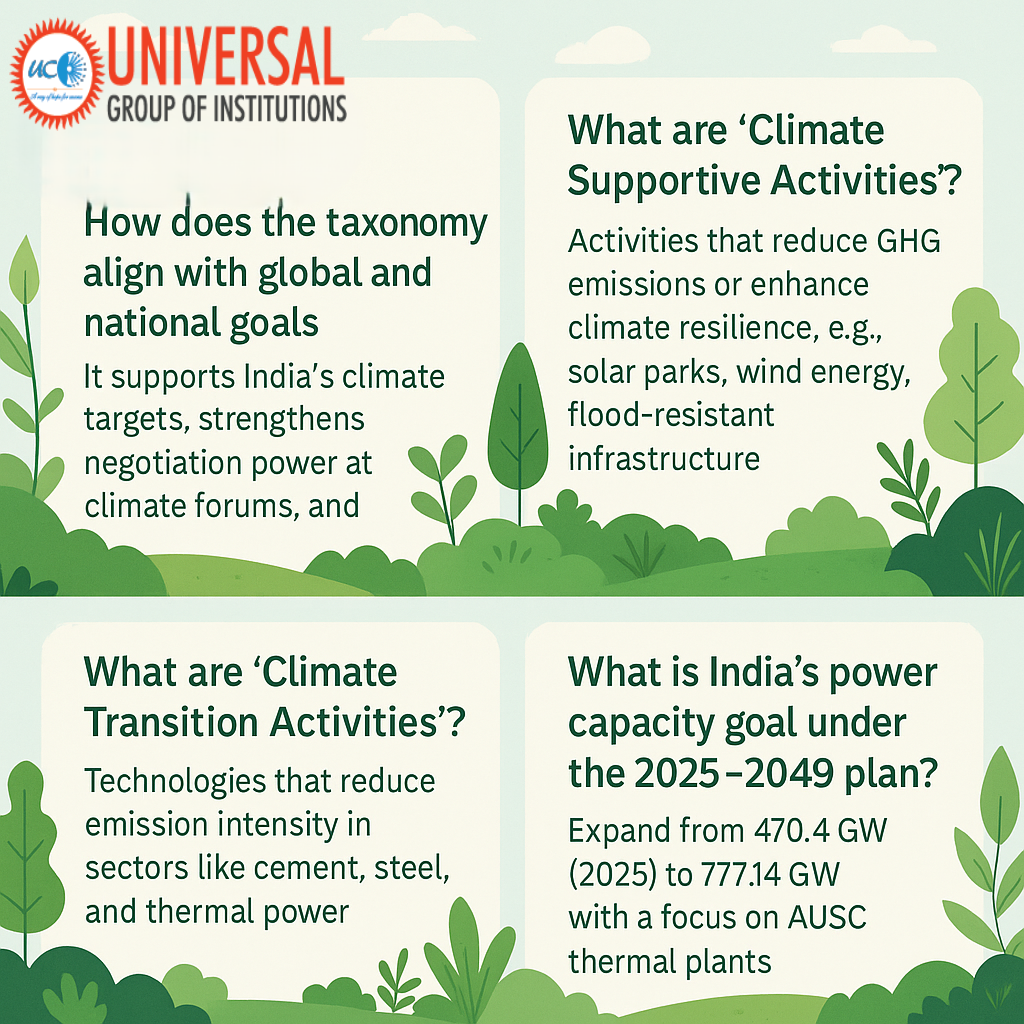

- Green (Climate Supportive): Directly reduce greenhouse gas emissions or enhance resilience (e.g., solar parks, flood-proof infrastructure, carbon neutral investments).

- Transitional: Help reduce emissions intensity in hard-to-abate sectors like iron, steel, and cement.

By categorizing climate-supportive activities, the taxonomy:

- Prevents greenwashing – the false or exaggerated portrayal of environmental responsibility.

- Ensures transparency and credibility in climate finance.

- Aligns with India’s climate commitments of achieving Net Zero by 2070 and becoming a Viksit Bharat by 2047.

- Promotes environmental impact investing across various sectors of the economy.

Objectives of the Climate Finance Framework

- Define sustainable finance: Provide a national benchmark to identify green or transitional activities within the sustainable finance framework.

- Promote climate-friendly technologies: Support innovations in clean energy, smart agriculture, and e-mobility through renewable energy funding and sustainable energy finance.

- Avoid misrepresentation (greenwashing): Set robust verification mechanisms for climate claims and enhance climate disclosure practices.

- Support international negotiations: Offer India a strong footing in global climate diplomacy, especially under frameworks like UNFCCC and COP, reinforcing India’s climate action goals.

- Optimize resource flow: Ensure efficient allocation of funds towards sustainable and climate-friendly projects, including carbon neutral investments and environmental impact investing initiatives.

Purpose and Global Relevance

- Investor Confidence: Acts as a credible decision-making tool for banks, financial institutions, and private investors engaging in ESG finance and environmental impact investing.

- Policy Benchmarking: Serves as a national reference for budgetary allocations and public-private partnerships, potentially influencing the Union Budget 2024-25.

- Global Strategy: Counters exaggerated climate finance claims by developed countries and strengthens India’s position in climate finance accountability and climate risk management.

- Climate Capital Mobilization: Facilitates the flow of climate capital towards green and transitional projects, accelerating India’s progress towards its climate commitments.

Key Sectors Identified

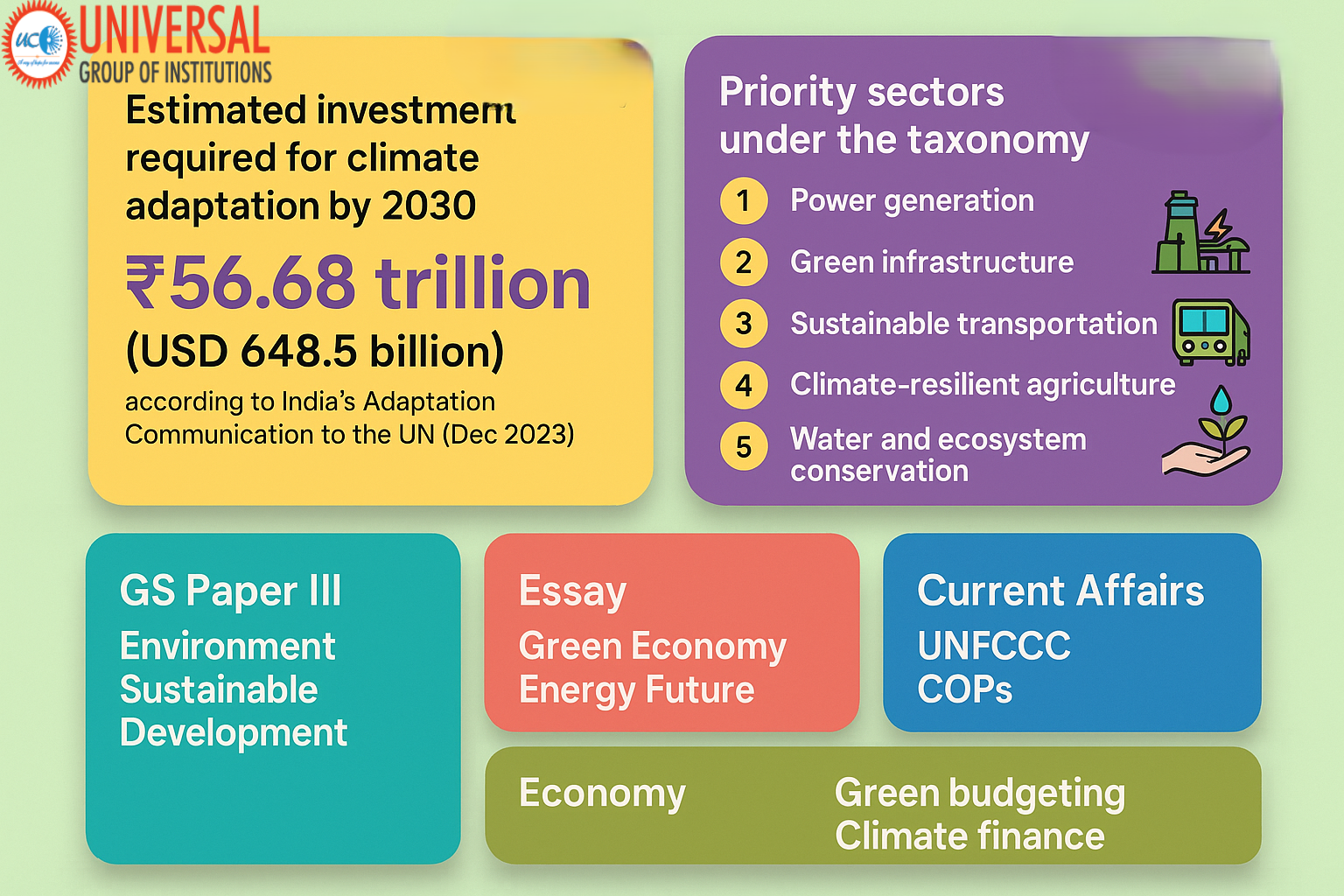

India’s taxonomy outlines priority areas that will receive climate-tagged investments and support the green transition:

- Power Generation: Including both renewable energy and low-emission thermal technologies, supported by sustainable energy finance and aimed at providing reliable energy that is affordable.

- Buildings & Green Infrastructure Projects

- E-Mobility and Public Transport

- Climate-Resilient Agriculture and Smart Food Systems, backed by sustainable agriculture funding

- Water Security and Ecosystem Management

These sectors are further detailed in sectoral annexures, providing specific guidelines for transition projects within each area.

India’s Climate Investment Targets

Power Sector Scale-Up (2025–2049)

- Target: Expand installed capacity from 470.4 GW (2025) to 777.14 GW

- Key Technology: Advanced Ultra Super Critical (AUSC) thermal plants with 46% efficiency

- Compared to:

- Subcritical: ~38%

- Supercritical: ~41–42%

- Compared to:

- Goal: Achieve higher efficiency and significantly reduce emissions per unit of electricity produced, supporting the low-carbon economy transition and providing affordable energy that is both sustainable and reliable.

Climate Adaptation Finance Estimate

- Total Requirement by 2030: ₹56.68 trillion (≈ USD 648.5 billion) (As per India’s Initial Adaptation Communication to the UN, December 2023)

Major Investment Areas for Climate Mitigation Investments:

- Agriculture and Forestry

- Fisheries

- Rural and Urban Infrastructure

- Water Resources

- Ecosystem-Based Adaptation

These climate-aligned investments aim to minimize the risks posed by climate change and build long-term resilience through comprehensive climate risk assessment.

UPSC & Competitive Exam Relevance

This taxonomy is relevant under:

- GS Paper III (Environment, Sustainable Development, Climate Change, Indian Economy)

- Essay Paper: Themes like Green Economy, Climate Justice, India’s Global Climate Responsibility

- Prelims & Mains Current Affairs: UNFCCC, COP Summits, Net Zero commitments

- Economy Topics: Public Investment, Sustainable Financing, Climate Budgeting

- Green finance UPSC: Understanding the role of climate taxonomy in shaping India’s sustainable development goals financing

Conclusion

India’s Climate Finance Taxonomy 2025 is a transformative framework in the realm of sustainable finance and carbon neutral investments. By creating clear definitions for green and transitional investments, the taxonomy not only channels funds to climate-aligned sectors but also boosts investor confidence, ensures regulatory clarity, and elevates India’s global climate leadership. The Draft Framework provides a robust foundation for climate risk management and facilitates the issuance of green bonds and other sustainable finance instruments. It is a critical milestone for India’s transition pathway toward Net Zero and a resilient economic future, emphasizing the importance of net-zero transition planning across all sectors. By incorporating science-based transition pathways, the taxonomy ensures that India’s climate finance strategy is grounded in the latest environmental research and technological advancements, paving the way for a sustainable and prosperous future while fulfilling its climate commitments on the global stage. This framework will play a crucial role in promoting environmental impact investing and ensuring access to affordable energy as India moves towards its climate goals.